Join us on an adventure through the LT Bitcoin Chronicles – An introduction to Leverage Trading Bitcoin to make money in minutes.

Leverage Trading Bitcoin Outline

After going through this article, you’ll:

-

- Have a clear understanding of Leverage Trading Bitcoin.

- Discover its benefits and why it’s an important strategy to consider.

- Learn about the mechanics of how it works.

- Know the advantages and disadvantages of Leverage Trading compared to regular Trading.

- View our comprehensive trading formula layout, tips, warnings, and rules to remember.

- Get a step-by-step guide on how to quickly and easily buy Bitcoin and begin trading within minutes, even if you’re new to Bitcoin. You can start with as little as $2 if you prefer.

⚡️⚡️An essential component of your success will be staying informed. You can revisit this page to:

-

- Review the formula (as it can be a lot to remember).

- Discover and learn the new information and strategies that have been added

So What Are the Benefits of Trading Bitcoin with Leverage?

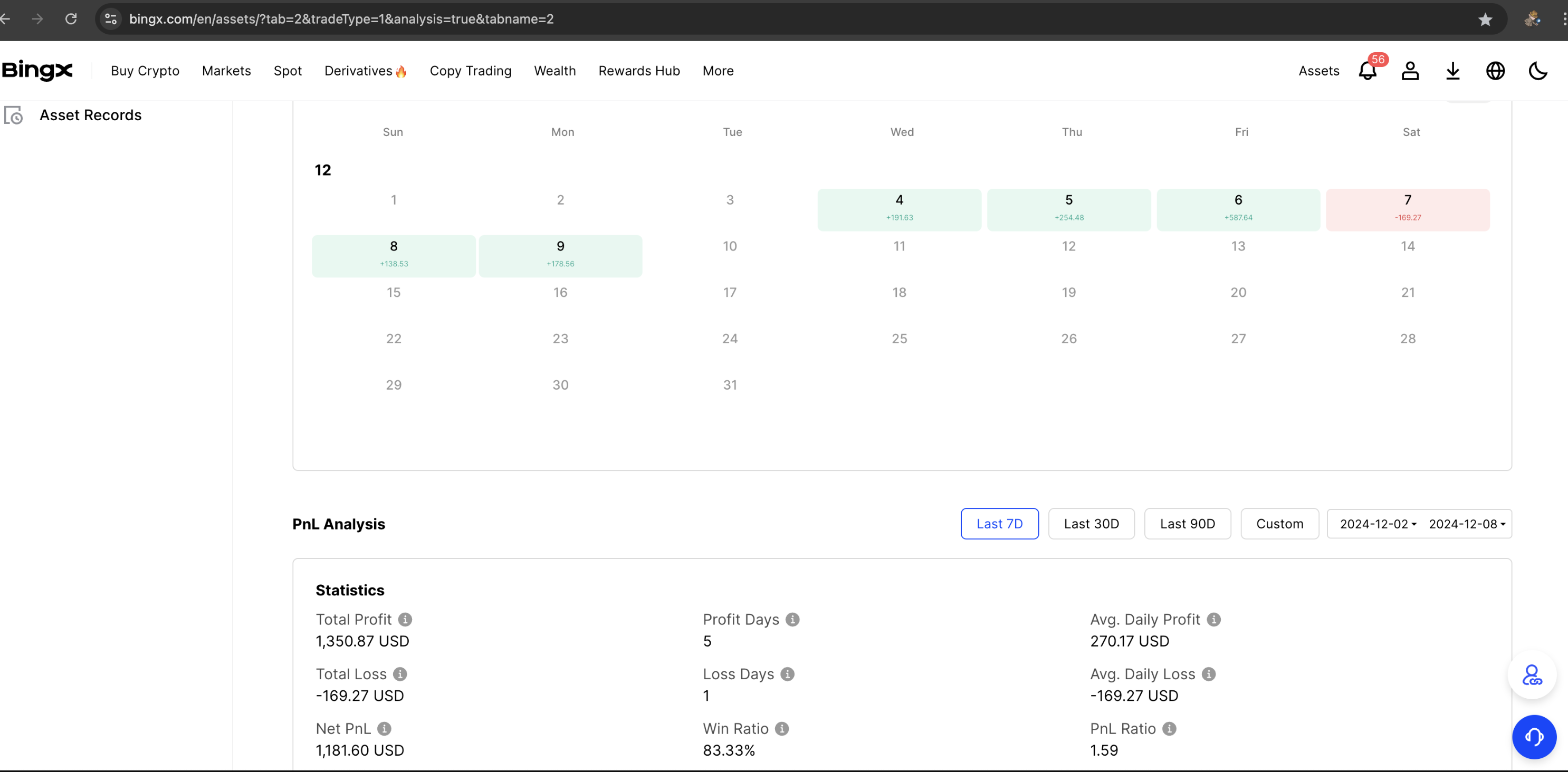

To begin with, there are weeks when you may experience something like this –

_ZOOM IN_This was a screenshot that I took on December 08, 2025, at 9:25 PM of my BingX account, showcasing the PnL analytics data. https://business.infosearched.com

Note that the screenshot above does not display a flawless week of profits, which is often used to promote the advantages of some sort of product. Instead, I aim to be completely upfront in revealing that, even during a successful week, Leverage Trading (Futures Trading) involves inherent risk. Proceed at your own discretion.

The world is constantly evolving. Your laptop has now become the modern-day Wall Street. The typical investment into a Coin for a long period of time and getting rich, is becoming a thing of the past. Instead, we capitalize on the fluctuation of Cryptocurrencies. So I don’t pout over Bitcoin’s occasional dips. Why?..because I’m successful trading Crypto in either direction with Leverage.

Although opting to buy and hold Bitcoin/Cryptocurrency may initially appear to be a safer choice, not having any other options actually limits your control over the potential profit. Rather than actively earning, you are left waiting and relying on hope. This is the pivotal distinction between the two approaches.

By simply following this guide and my formula, you can quickly discover how leveraging trading Bitcoin/Crypto…can actually be even safer than traditional trading(I’ll explain more later). Not only does my strategy give you more control, it also offers a more rewarding and efficient way to profit in the crypto world.

Yet, there’s also another method to achieve even faster gains from Cryptocurrencies. Yup…there is. However It’s important to note that the risks are greater than leveraging crypto. Continue reading for additional information.

Quick Money vs Good Money

As previously mentioned, there is an even quicker method for earning profit through cryptocurrencies – Meme Coins. And it’s only for the thrill seeker who doesn’t mind losing money constantly.

Luckily, there’s a solution for staying relatively secure, however, also immensely profitable in the chaotic realm of Meme Coins – and that’s by utilizing our website, https://coinpump.infosearched.com (shameless plug🔥).

But for now let’s focus on our main goal here – making Good Money.

Although trading Bitcoin or any Cryptocurrency with leverage can be a hyper-fast process as well, our main purpose is to steer individuals away from that mindset or behavior altogether. Instead, I’ll show you a reliable and consistent method – the safest approach I know – to achieve success within this matrix.

The Tools

Before I begin teaching you the formula or demonstrating it to you, it is important for you to become familiar with the tools used for execution. So watch the video below of a well-known trader trading on BingX. Pay close attention to how he navigates to…and from the Bitmex website to analyze time frames better.

Do not pay attention to anything other than his use of Bitmex to check the time frames, and his tutorial on BingX, as the goal of this video is not to demonstrate a successful strategy. In reality, he actually ends up losing the trade.

-Check out his beginner tutorial for BingX-

Use Ivacy as your VPN

Also before delving any further into Leverage Trading, I can’t stress this enough…it is important to again acknowledge the high level of risk involved.

Additionally, getting well-versed in reading and interpreting charts is essential. The different chart times aid and assist in determining the optimal entry and exit points for trades on any platform.

And I strongly recommend trading on Bing X though, as it’s the leading platform for trading Cryptocurrencies right now.

Although the following 3 minute demo video I shot below was done on Bitseven, which is no longer available, its technicality is the same. Furthermore, Bing X offers a more powerful but user-friendly experience for traders.

I actually created this video in the past to demonstrate the power of Leverage trading (and, in a way, I am still doing that now, ha ha). However, please don’t take any strategies from this video either. It’s simply meant to be proof of me being a credible source when it comes to Leverage Trading Cryptocurrency.

$100 in 3 minutes Training video –

The Bitseven Platform – no longer available

Early on, I spent countless hours in front of my computer trying to understand the charts. I had to uncover the secrets behind this monster.

And as a result, I’ve invested significant amounts of money into testing various methods and strategies. But despite so many attempts and failures, I eventually found a winning system that yielded successful results for me…consistently.

Please keep in mind that this is not investment advice, but rather, an insight into what has works for me. As we progress, I’ll provide a detailed breakdown of my approach.

Again, we’ve been trading on platform called BingX, that’s even better than BitSeven and Margex.

Regardless of the platform, Winning Trades can become highly addictive. By utilizing the right strategy, trading is possible on any platform.

More Proof

Short Margex demo vid 1

A Couple Of My Trades On Margex

Quick trade on Margex

In and out trade. Small profit, but done fast.

How It All Works

Leverage Trading Bitcoin allows you to utilize a platform’s available market capital to make trades; in other words, you’ll be trading with other people’s money added to your own to bring in a higher profit.

So you either trade up (known as “going long“), or you trade down (known as “going short” or “shorting the trade“). Easy stuff here, right? Well, that’s the only mention of it being “easy” you’ll hear from me moving forward. Everything else is super-intense.

It’s crucial to understand how Leverage Trading works before entering this market. Unlike the stock market, Cryptocurrencies are not traded on a central exchange. It functions through a technology called the Blockchain.

And it’s a herd mentality that affects the bids and prices, making Bitcoin and other Crypto prices move in erratic patterns. And so sometimes you’ll hear the term Bull-Run, which is when the Bitcoin/Crypto price either has or is predicted to skyrocket up (a.k.a, The pump). And you’ll also hear the phrase Bear-Run, which is when the Bitcoin/Crypto price either has or is predicted to shoot down (a.k.a, The dump or crash). And it can happen instantly and at any time while you’re trading. So always be mindful of this and practice trading with only small amounts first.

5 Rules To Remember

- Never go into a trade with 100% of your wallet/account balance –

This is probably the worst mistake you could ever make while trading. You can be in the profit, and in less than a second, the direction could change and possibly liquidate you (lose all the money you put into the trade). However, it’s also possible that the same volatility can happen to go in your direction, and you could return a massive profit from going all in. But I wouldn’t recommend you do that. And I strongly suggest that you don’t. It’s simply not worth the risk. Trust me, I know.

In Leverage, it doesn’t take a lot to get over-confident and cocky when you’re winning 98% of your trades . My point is that even when you start seeing consistent success, please understand… that’s the moment when you’re at risk the most. You start getting comfortable and begin to lower your guard a bit.

. My point is that even when you start seeing consistent success, please understand… that’s the moment when you’re at risk the most. You start getting comfortable and begin to lower your guard a bit.

You should only enter trades with no more than 5% of your wallet when just starting. So if you have $1000 worth of Crypto in your account, you should only make $50 trades. Or if you’ve got $2000 in the wallet, make $100 trades. And as you become a better Leverage Trader, you can increase trade amount. But if you want consistency, never put more than 20-25% of your wallet into a trade. - Never trade out of FOMO (fear of missing out) –

Jumping into a trade late is not what you want to do. Your trade entry positioning is everything. Entering late and trying to profit from the ongoing push that Bitcoin is making is a rookie mistake that can cost you. It’s safer just to let it go and accept that you’ve missed this one. They’ll be others, trust me. What goes up must come down and vice-versa. So wait, no matter how long it takes. You’ll be better off.

Three outcomes can happen if you don’t wait:

You may get lucky and win the trade with a slight or significant profit. (It happens)

The Bitcoin price direction will change, eventually forcing you to stop the trade while you’re heavily negative or get Liquidated. (Likely)

The Bitcoin price will beam (rapidly move) against you in the other direction, Liquidating you almost instantly without giving you a chance to stop the trade. (Likely)

The point that I’m trying to make here is that you need to have a lot of patience to enter a trade successfully. Don’t be forced into one out of FOMO. It would be best if you built up a super-power of patience. And that’s easier said than done, but it’s something that you have to be mindful of trade-by-trade. - No greediness –

You’ll probably get over-confident or just plain out cocky when you reach a point where you almost always win all of your trades. It happened to me. But that’s destructive. It’s even worse when you’re just starting, having some early success, and then getting cocky. So if and when you’re doing well in a trade, don’t stay in it for too long. Take the profit whenever possible. It’s better to get a smaller profit than you would have wanted than lose the trade completely because you wanted to make as much as possible. Remember, Bitcoin’s direction can change on you in less than a second sometimes.

The fact of the matter is that Bitcoin does what it wants when it wants. Anyone who can consistently predict what Bitcoin will do is either lying to you or completely delusional. We’re doing, and what I teach is how to capitalize on what Bitcoin is doing in real-time. In and out quickly. But you’ll learn more on that later when I unveil my formula, so keep reading. - No emotions –

I can’t stress this point enough…never put any amount in a trade that you’re not willing to lose. The road to becoming successful consistently in Leverage Trading is never trading with any amount that makes you uncomfortable. You have to not care about the trade to learn from your mistakes. Even when you finally become a pro, if you’re nervous while in a trade, then you’re trading with too much. - Please read and understand the Terms Of Service on Margex (located near the bottom of their homepage) –

Before you get started trading on Margex, you’ll want to read their Terms Of Service. If you live in the U.S., they’ll shut your account down in a heartbeat. Sure, they’ll give you a couple of days to withdraw your money, but after that, your account will be blocked. I’ve heard (LOL) that you can get around that issue if you use a VPN. But please, be safe and read their terms to find out if your country can trade on Margex. Within their terms, it lists the countries that are not allowed.

The Formula

You might be reading this guide-post while I’m still in the process of writing it and saying, “Well, where’s the formula?” My apologies, It’s been a while since I started this guide because I’ve been swamped and, quite frankly, just plain old procrastination. But please don’t be upset, it will get done soon. Just check back here every day if you can. I’ll be giving you a lot of information, and trust me, it will be well worth the wait. Think of, and use this page as your Bitcoin Leverage Trading live journal. There will also be an “Updates” section that will be dated and updated regularly with different strategies, Bitcoin news, and more. So stay tuned. And thanks for reading this. Now here’s my formula:

(Step 1) Always Remember This –

Having lots of money to trade with only benefits you if you have the patience enough to only trade with 5% or less of your total wallet balance at all times. This patience is tough to maintain as you start winning consecutive trades. But being disciplined in this way helps you mature as a leverage trader. And it also allows you to be able to hang around long enough to profit consistently.

And no, you don’t need to have a lot of money to trade with to become successful at leverage trading. Again, as long as you have the patience enough to only trade with 5% or less of your total wallet balance at all times, you’ll succeed. It just takes longer for you to profit with smaller amounts significantly. However, I highly recommend starting out trading with smaller amounts first. Trading with smaller amounts allows you to get plenty of practice and a better feel for leverage trading bitcoin.

So whether you’ve got a little or a lot to trade with, if you don’t have, or even attempt to build up some sort of patience, plus apply the 5% or less rule, you won’t last.

(Step 2) The Game Plan –

You’ll need to know and understand what we’ll be doing here. What this formula’s structure is, and why it works so well for me. We’ll be doing what’s sometimes called “trading on the one-minute chart.” And for me, it’s a quick in and out situation, trading-wise. It’s knowing when to enter and exit a trade based on the one-minute chart’s actions. We’ll also be looking at the other charts, but the one-minute chart will ultimately determine what we’ll do. Remember I mentioned what the charts were early-on in this guide. Go back to it if you need to.

(Step 3) The Chart –

The chart on Margex is not the chart we will be primarily using to enter and exit trades. You can if you want to, but that’s not what works for me. I use another platform called Bitmex to read and watch the charts. Now, I don’t trade on Bitmex. I only use their charts. You can use Bitmex charts for free. No need to sign up. But all the trading is done on Margex. So to clarify it once more, we’re studying the Bitmex charts and then entering a trade on Margex. So you’ll need to make sure that what you see happening on the Bitmex chart is also happening on the Margex chart. You’ll be switching browser tabs between the two platforms constantly as your trading. Or you can use two different monitors. It doesn’t matter. Either way will get the job done.

Switching between Margex and Bitmex – (no audio)

Margex is the best for trading. However, my system uses the charts on Bitmex to determine when to get in and out of trades. Once you’ve decided that you’re ready to start a trade based on what you see happening on Bitmex, then you quickly start the trade on Margex.

Here’s an example of what entering and exiting a trade on Margex based on the Bitmex chart values might look like:

Entering and exiting a trade on Margex (no audio/hyper speed)

So now you’ll need to learn how to read the charts to understand what we’re looking for. There are multiple time frames that you can view on the chart. But we’ll be paying close attention to the 3-minute, 1-hour, 4-hour, 6-hour, 1-day, and most importantly to my formula, the oh-so-intense 1-minute chart.

So using the Bitmex chart, we’ll be looking for what’s called “Clear Direction.” When you start Leverage Trading Bitcoin based on the 1-minute chart, you’ll notice that Bitcoin has a time when the price is steadily going up. And there’s also a time when it’s steadily going down. Whichever direction Bitcoin happens to be moving steadily in at that time, is what Clear Direction is.

So now that you know what Clear Direction is, it’s time to find it using the charts. So head over to Bitmex and favorite the 1-minute, 3-minute, 1-hour, 4-hour, 6-hour, and 1-day charts. I’ll show how to do this and also how to set it up in the exact way that I use it in the video below:

Finding Clear Direction with Bitmex

What I do here is pretty simple. I wait until the one-hour is following the direction of the six-hour charts. Then I patiently watch the one-minute chart while waiting for a gradual and steady decrease in bar sizes. And that decrease will ultimately have to be transitioning into the same direction as the one and six-hour charts. But beware that at any time, Clear Direction can and will change and go against the direction of one minute and day charts. So you have to be cautious and most of all, patient. Even if you’re doing everything right, you can be following clear direction and still lose the trade. There are no guarantees here. But the key here is to follow the clear direction of the one minute and the day chart at the right time.

So if the clear direction is down, then wait until the price is somewhere at the highest point of the Margex chart, and then you trade down. Or, if clear direction is up, then you wait until the price is somewhere at the lowest point of the Margex chart, and then you trade up.

(Formula works on a laptop, desktop, or big tablets only – it’s not meant for smartphone trading).

To have consistent success in leverage trading; you sometimes may have to wait hours and sometimes even bypass some opportunities to enter into a trade, in order to position yourself in the best possible way so you can profit.

Again, please understand that nothing is definite, and Bitcoin can and will go against Clear Direction throughout the day. Remember, Bitcoin does what it wants when it wants. Bitcoin hasn’t gotten to its current price by just staying still or being predictable. It moves. But there are ways to handle your trading if Bitcoin decides to change or reverse its Clear Direction on you.

(Step 4)

(Step 5)

(Step 6)

(Step 7)

Where To Go

- Join BingX –

Start Trading in minutes. Easy to use with excellent support staff. $1 Minimum deposit. Withdraw funds easy. - Buy Crypto from Coinbase –

You can purchase a variety of Cryptocurrencies here, but registration can be lengthy. - Buy Bitcoin from Cashapp –

Fast and easy to buy Bitcoin on a safe and secure platform. - Get your VPN from Ivacy –

One month plan is currently $9.95 a month. - Donations are appreciated –

You can send your donations to our bitcoin address by scanning the QR CODE below, thanks:

DISCLAIMER:

Everything seen in our videos or on this website is based only on our opinions and commentary. We are not financial advisors. All decisions are your own.

Please be careful if you decide to try this. Infosearched.com and the InfoSearched youtube channel are not responsible for any monetary losses that you may incur; nor are this video or the contents/description intended to be investment advice.

The risks of loss from investing in Cryptocurrencies can be substantial, and your investments’ value may fluctuate. Cryptocurrencies are complex and come with a high risk of losing money rapidly due to Leverage. So you should consider whether you understand how leverage trading bitcoin works and if you can afford to take the high risk of losing your money. InfoSearched is not licensed to conduct investment business or digital asset business.

How to make a cryptocurrency for less than $2

Internet Business Ideas

How does a blockchain work – Simply Explained

Fake Money Is Making You Poorer! Why Savers are LOSERS – Robert Kiyosaki [ Millennial Money ]

How we’ll earn money in a future without jobs | Martin Ford