Single Member LLC Mistakes You Should Avoid – 4 Biggies

Single Member LLC Mistakes

If you decide to form a single member LLC, you are probably doing so for the limited liability protection they offer. However, if you make one of these mistakes, someone who sues your business could “pierce the corporate veil” and get at your personal assets regardless.

How can commingling personal and business finances expose a single-member LLC to legal and financial risks?

Single Member LLC Mistakes You Should Avoid – 4 Biggies

A Single Member Limited Liability Company (LLC) can be an excellent option for entrepreneurs looking to protect their personal assets while still maintaining the flexibility and ease of a sole proprietorship. However, even with the benefits of this business structure, there are still critical mistakes that single member LLCs should avoid. In this article, we discuss four of the most significant mistakes to avoid.

1. Failing to Maintain Separation Between Personal and Business Finances

One of the most significant advantages of forming an LLC is the separation of personal and business liability. However, if you commingle your personal finances with your LLC’s finances, you could lose that liability protection. You must ensure that all your business transactions are kept in a separate account from your personal finances. Otherwise, you may expose yourself to legal and financial risks.

2. Not Maintaining Corporate Formalities

A single-member LLC has more flexibility when it comes to corporate formalities, but that doesn’t mean you shouldn’t have them. You need to maintain corporate formalities to ensure that your business remains legally compliant. Update and maintain your company’s articles of organization, create an operating agreement, and hold regular meetings to avoid the risk of being disregarded by the courts.

3. Failing to Obtain Necessary Permits and Licenses

Operating a business without proper permits and licenses exposes you to legal risks and costly fines. Before starting your single-member LLC, research and obtain all the necessary permits, and licenses for your business. Even if you are a single-member LLC, you must ensure that you have everything you need to operate within your local and state regulations.

4. Neglecting to Properly Document Your Business Decision-Making

Documentation is crucial for any business, and single member LLCs are no different. If you don’t document your business decision-making adequately, you may be exposing yourself to future legal risks. You must have a process in place for documenting your business transactions, such as keeping minutes for meetings or maintaining an email trail of significant decisions.

In conclusion, forming a single member LLC can be an excellent option for many entrepreneurs. Still, it’s essential to avoid these four significant mistakes to protect yourself and your business. By maintaining separation between your personal and business finances, documenting your business decision-making, obtaining necessary permits and licenses, and maintaining formalities, you can avoid costly mistakes and set up your single member LLC for long-term success.

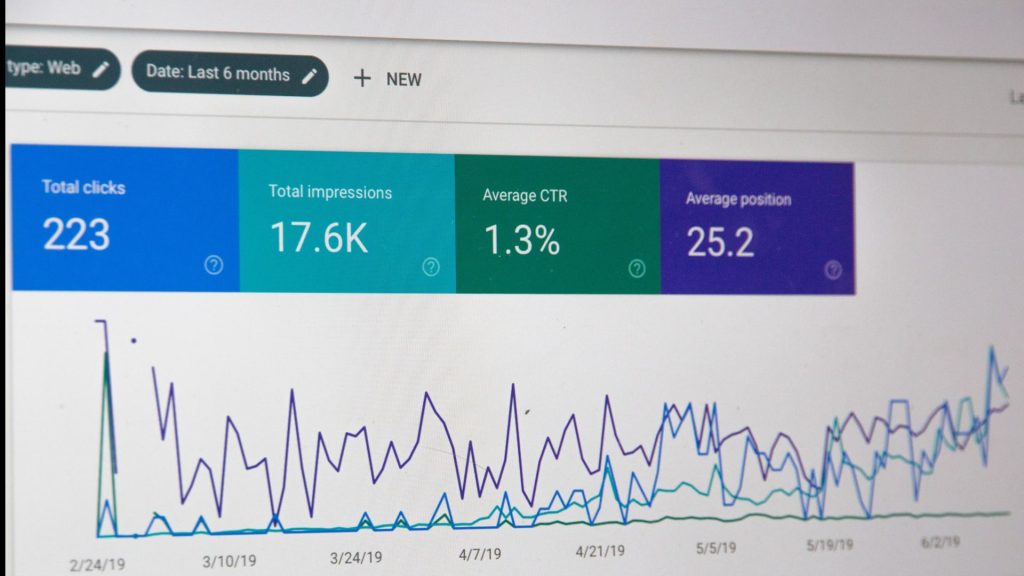

Top Ten Ways To Get Tons Of Traffic

A Simple Japanese Money Trick to Become 35% Richer

What It’s Like On The Longest Flight In The World On Singapore Airlines

How To Build Strategic Partnerships and Grow Your Business: for Entrepreneurs and Freelancers

5 Reasons You Should Use A Blog