How a Sole Proprietorship Works | Introduction to Legal Structures

Starting a business is an exciting venture, but one of the biggest decisions an entrepreneur needs to make is choosing the legal structure for their business. One common type of business entity is a sole proprietorship.

This legal structure is often the go-to choice for entrepreneurs and small business owners, but what exactly is a sole proprietorship and how does it differ from other legal structures for businesses?

Simply put, a sole proprietorship is a business that is owned and operated by a single individual. This means that the owner is solely responsible for all aspects of the business, including decision making, profits, and liabilities. Unlike other legal structures such as partnerships or corporations, a sole proprietorship does not require any formal registration with the state or federal government. As long as the business is operating under the owner’s name, it is considered a sole proprietorship.

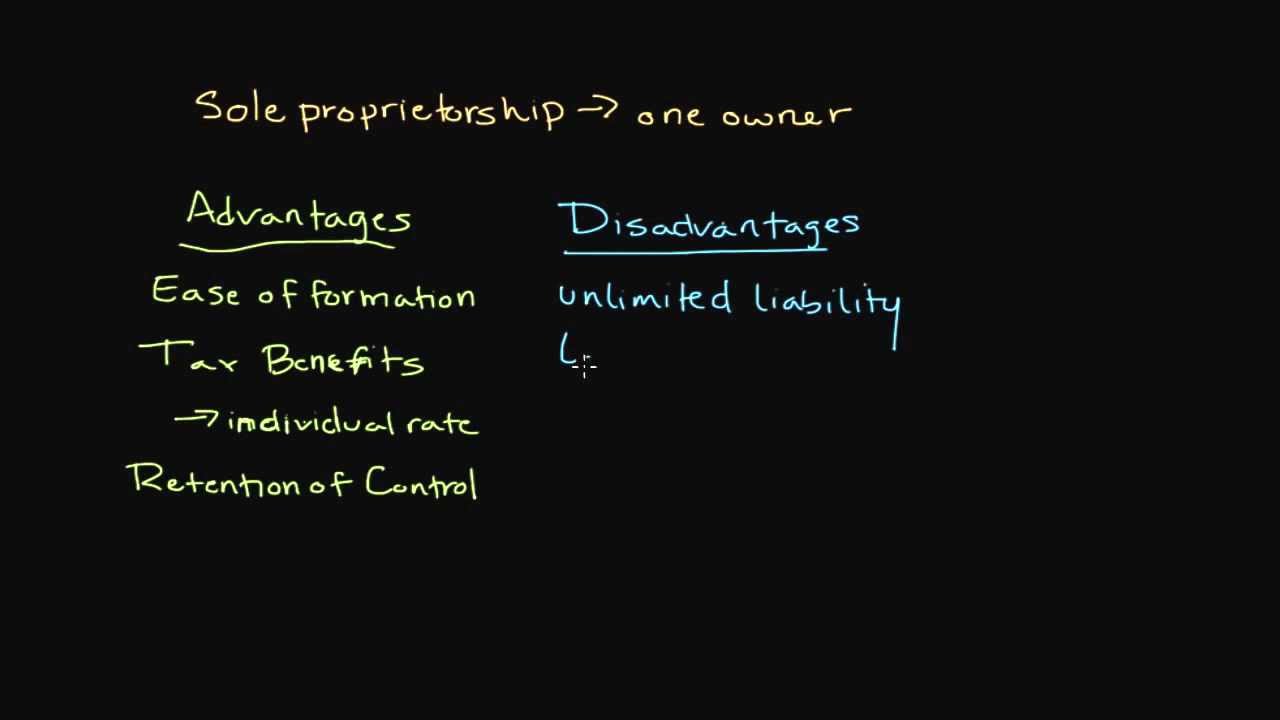

One of the main advantages of a sole proprietorship is the ease of setup and management. Unlike other legal structures, there are no complex legal processes or hefty fees associated with starting a sole proprietorship. This makes it an attractive option for entrepreneurs who want to launch their business quickly and with minimal expenses.

In addition, sole proprietorships are subject to fewer regulations and legal formalities compared to other business entities. For example, there is no need for annual filings or meetings with shareholders, making it a simpler option for small businesses or individuals just starting out.

However, with this simplicity comes a major disadvantage – unlimited liability. In a sole proprietorship, the owner is personally liable for all debts and legal obligations of the business. This means that if the business is sued or runs into financial trouble, the owner’s personal assets could be at risk. This is in stark contrast to a corporation, where the shareholders have limited liability and their personal assets are protected.

Another downside of a sole proprietorship is the limited ability to raise capital. Since the business is solely owned by one individual, it can be challenging to secure funding from external sources, such as banks or investors. This can hinder the growth and expansion of the business in the long run.

So, how does a sole proprietorship differ from other legal structures for businesses? To understand the differences, let’s take a look at two other common business entities – partnerships and corporations.

Partnerships are similar to sole proprietorships in that they are relatively easy to set up and do not require extensive legal formalities. However, the key difference is that with a partnership, the business is owned by two or more individuals who share profits and liabilities equally. This can help distribute the risk among partners, but it also means shared decision-making and potential conflicts between partners.

On the other hand, corporations are a separate legal entity from its shareholders. This structure offers limited liability protection to its shareholders and is ideal for businesses looking to raise capital from investors. However, corporations are subject to more rigorous legal requirements, making them more complex and costly to establish and maintain.

In conclusion, a sole proprietorship is a simple yet risky legal structure for businesses. It is easy to set up and offers complete control to the owner but also carries the burden of personal liability. It is essential for entrepreneurs to carefully consider the advantages and disadvantages of this structure before making a decision. Depending on the goals and needs of the business, other legal structures may be more suitable and offer better protection and growth opportunities in the long run.

Billionaire Dan Pena’s Ultimate Advice for Students & Young People – HOW TO SUCCEED IN LIFE

A Click On Your Profits

SHE FAKED AN ART GALLERY IN LONDON AND SOLD MY PAINTINGS *it worked!!*

Matthew McConaughey | 5 Minutes for the NEXT 50 Years of Your LIFE

What is Blockchain Technology? (In Simple Terms)