“How To Buy Out Your Business Partner (And How To Value Any Business)”

As business partnerships continue to evolve and grow, there may come a time when one partner decides to leave the company.

This could be due to retirement, personal reasons, or simply a desire to pursue different opportunities. In such situations, a buyout process is necessary to ensure a smooth transition and a fair outcome for all parties involved. However, buyouts can often be complex and emotionally charged, which is why it’s essential for business partners to take certain steps to ensure a successful buyout process. In this article, we will discuss the steps business partners can take to ensure a smooth buyout process.

1. Communication is key

The first and most crucial step in a buyout process is effective communication between the partners. It’s essential to sit down and have an open and honest discussion about the buyout and its implications for both parties. This includes discussing the terms and conditions of the buyout, the value of the company, and the roles and responsibilities of each partner. Clear communication at the outset can prevent misunderstandings and conflicts later on in the process.

2. Get a valuation of the company

Before any buyout negotiations can begin, it’s important to know the true value of the company. This not only gives both parties a fair idea of what they are dealing with, but it can also prevent any discrepancies or disagreements in the future. Hiring a professional valuation expert or using reliable valuation software can help determine the true worth of the company, taking into account factors such as assets, liabilities, and market conditions.

3. Determine the payment terms

Once the value of the company has been established, the next step is to negotiate the payment terms. This includes deciding on the amount to be paid, the mode of payment (lump sum or installment), and the timeline for payment. It’s essential for both parties to come to a mutual agreement on these terms to ensure a smooth buyout process.

4. Put it in writing

It’s crucial to have a written agreement that outlines all the terms and conditions of the buyout. This includes the purchase price, payment terms, and any other obligations or guarantees. Having a written contract protects both parties and gives them a reference point in case of any disputes or disagreements in the future.

5. Seek legal and financial advice

Buyouts can involve complex legal and financial processes, and it’s important to seek professional advice from lawyers and financial experts. They can help review the agreement and ensure that all legal and financial aspects are taken into consideration, protecting the interests of both parties.

6. Plan for the future

A buyout can have a significant impact on the future of the company and its remaining partners. It’s essential to think about how the company will be managed after the buyout and put a plan in place to ensure its continued success. This can involve discussing roles and responsibilities, hiring new partners, and creating a long-term strategy for the company’s growth.

In conclusion, a buyout process can be a challenging time for business partners, as it involves significant financial and emotional decisions. However, by taking these steps, both parties can ensure a smooth and successful buyout process, allowing them to move forward towards new opportunities and growth. Clear communication, professional advice, and careful planning are key elements in achieving a fair and mutually beneficial outcome for all parties involved.

Step-By-Step Guide to Writing eBook

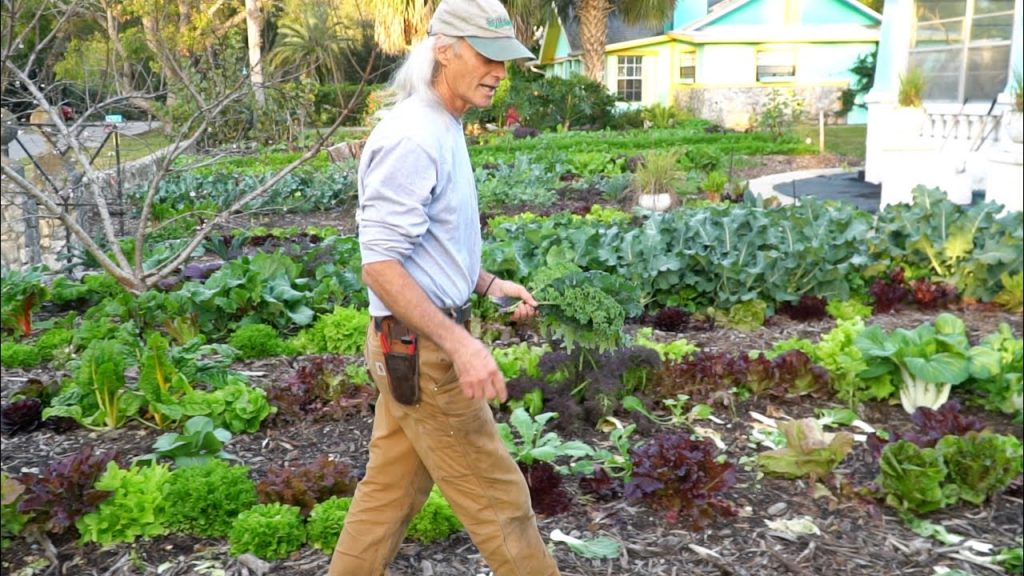

$1000 A Week: Front-Yard Market Farming + Bicycle Delivery Jim Kovaleski

LTO | BlockchainBrad | Hybrid Business Blockchain | Easy & Scalable | Tokenised Enterprise

How to Choose the Right Business Partner

How To Build Strategic Partnerships and Grow Your Business: for Entrepreneurs and Freelancers